Report: $SPY Prediction Benchmarks

This report provides a detailed quantitative and qualitative analysis of three AI models—GPT-4o, Gemini, and Grok 3—used to predict the closing price of the $SPY ETF from April 22 to May 30, 2025. The objective is to evaluate model accuracy, confidence calibration, reasoning quality, and directional prediction reliability.

Disclaimer: The insights and conclusions presented in this report are the result of human-led research and analysis. AI was utilized solely to assist in transcribing and structuring the content into written form. All interpretations, and judgments were made by human analysts. This report is for informational purposes only and does not constitute financial advice. I am not a licensed financial advisor, and any investment decisions should be made in consultation with a qualified professional.

Data Overview

- Total Predictions: 81 (27 per model)

- Prediction Period: April 22, 2025 – May 30, 2025

- Models Evaluated: GPT-4o, Gemini, Grok 3

- Prediction Range: $505.75 to $596.80 (mean: $569.16)

- Actual Closing Prices: $535.42 to $594.85 (mean: $572.66)

- Confidence Range: 40% to 85% (average: 69.72%)

Methodology

Quantitative Metrics

- Absolute Error: |Predicted - Actual|

- Percentage Error: (|Predicted - Actual| / Actual) × 100

- Confidence Error Gap: Confidence % - (100 - Percentage Error)

- Negative indicates overconfidence; positive indicates underconfidence.

Qualitative Assessment

- Evaluation of textual reasoning provided by models.

- Analysis of confidence alignment with prediction rationale.

- Identification of error patterns in various market conditions.

Quantitative Findings

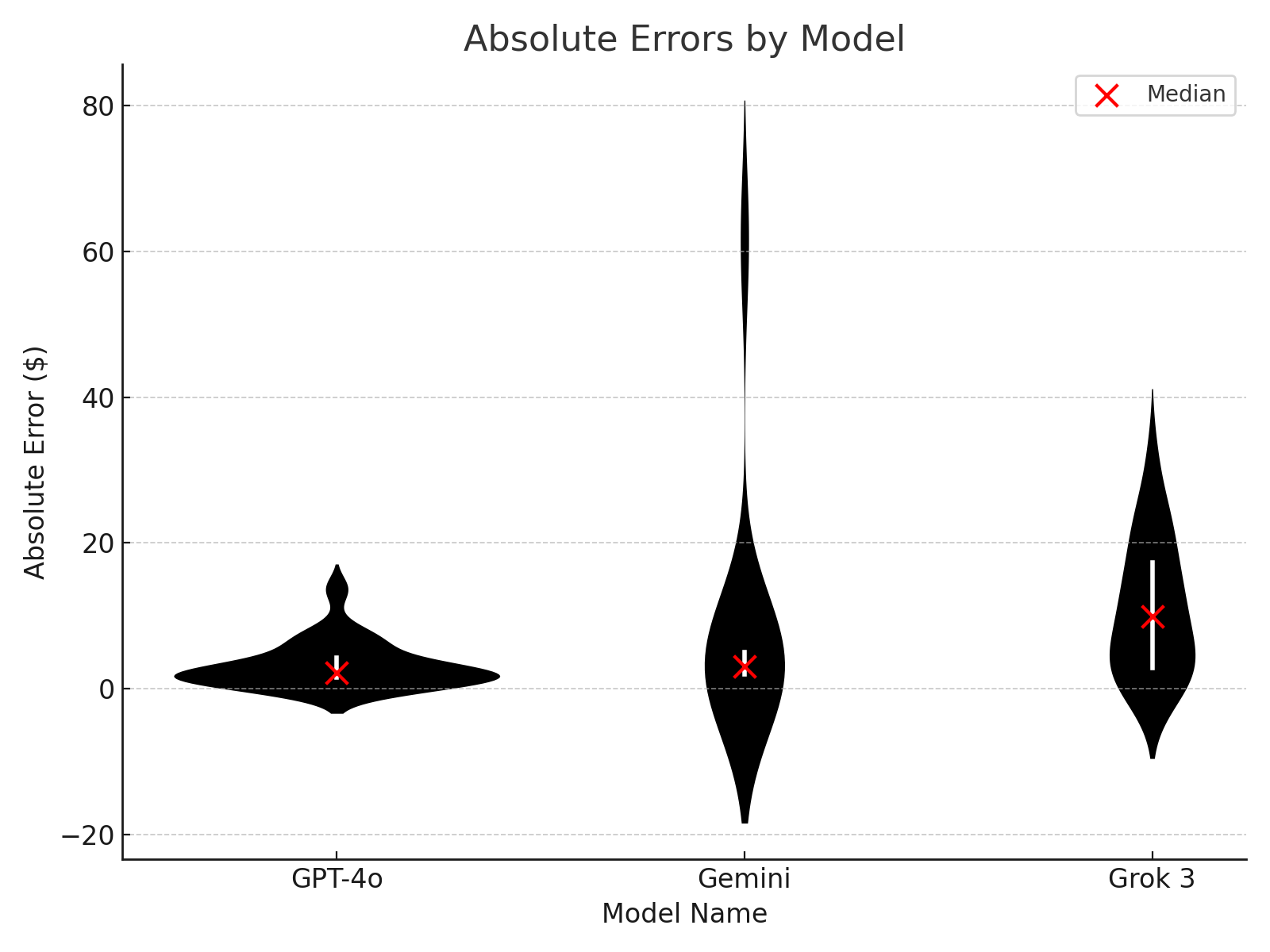

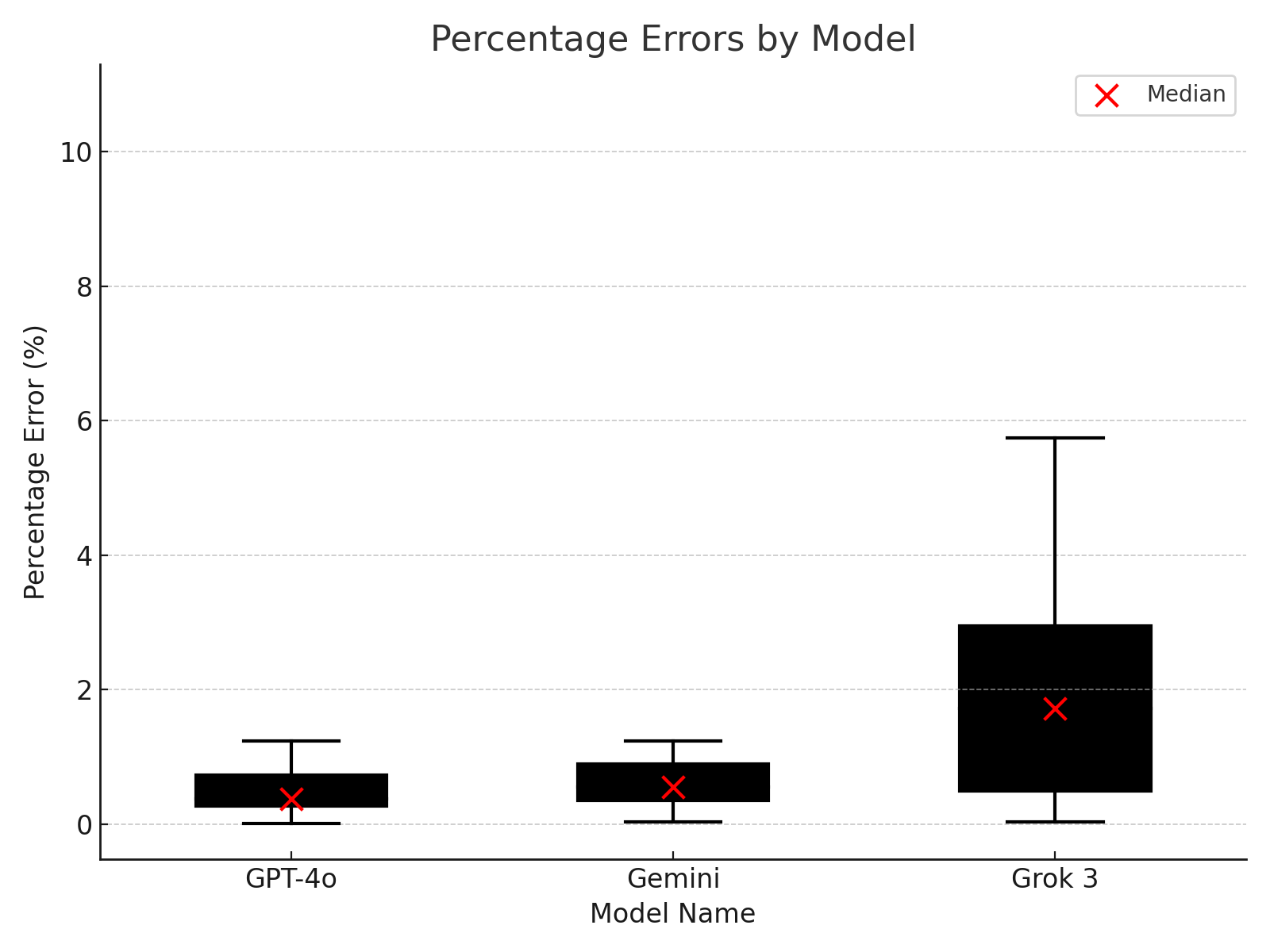

Absolute and Percentage Error

- GPT-4o consistently exhibits the lowest errors, indicating strong accuracy.

- Gemini demonstrates variability and higher error peaks.

- Grok 3 shows moderate accuracy but less consistency.

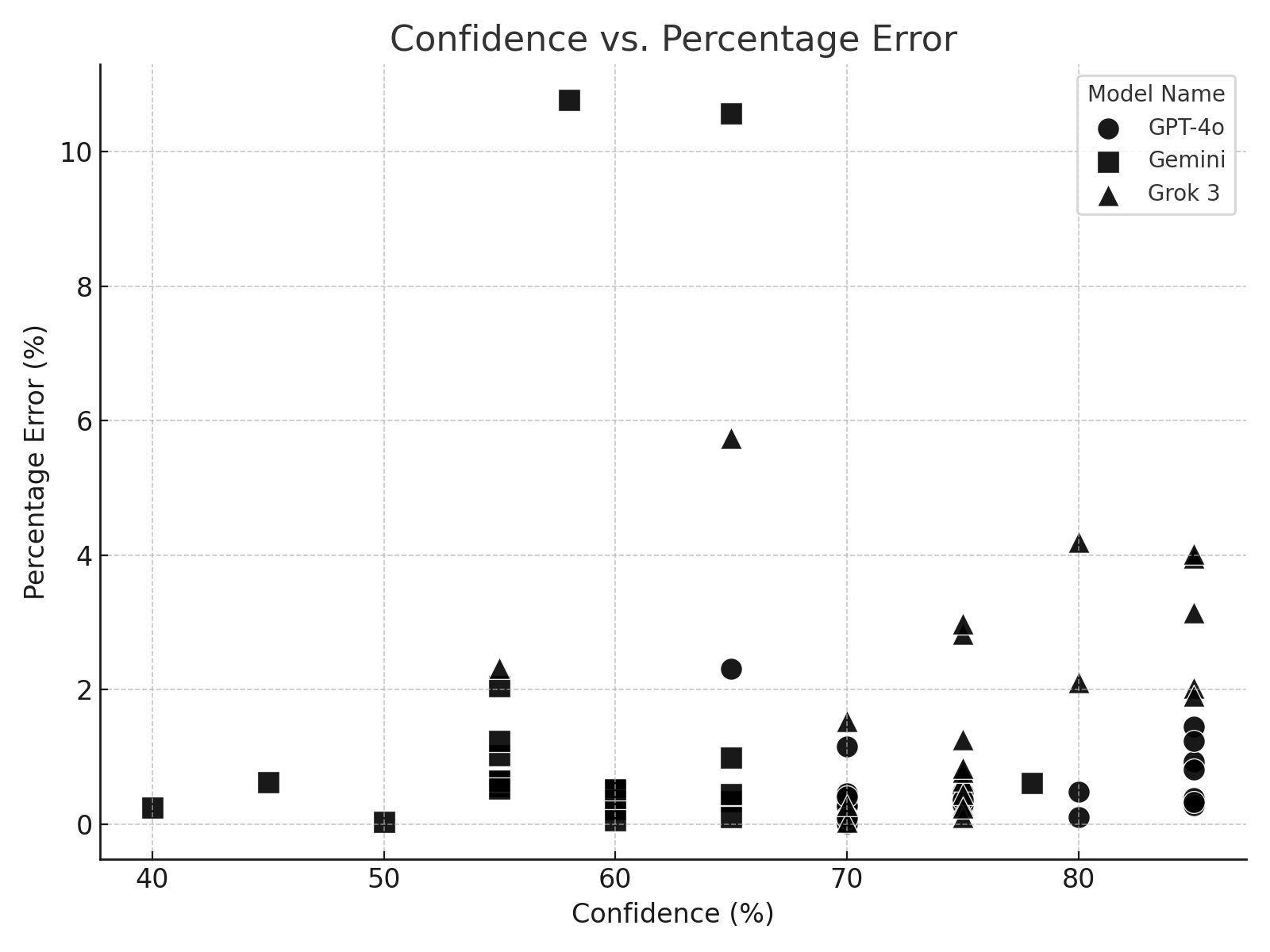

Confidence Calibration

- Average Confidence Error Gap: -28.92%, indicating overall moderate overconfidence.

- GPT-4o displays best calibration; Grok 3 has notable calibration issues.

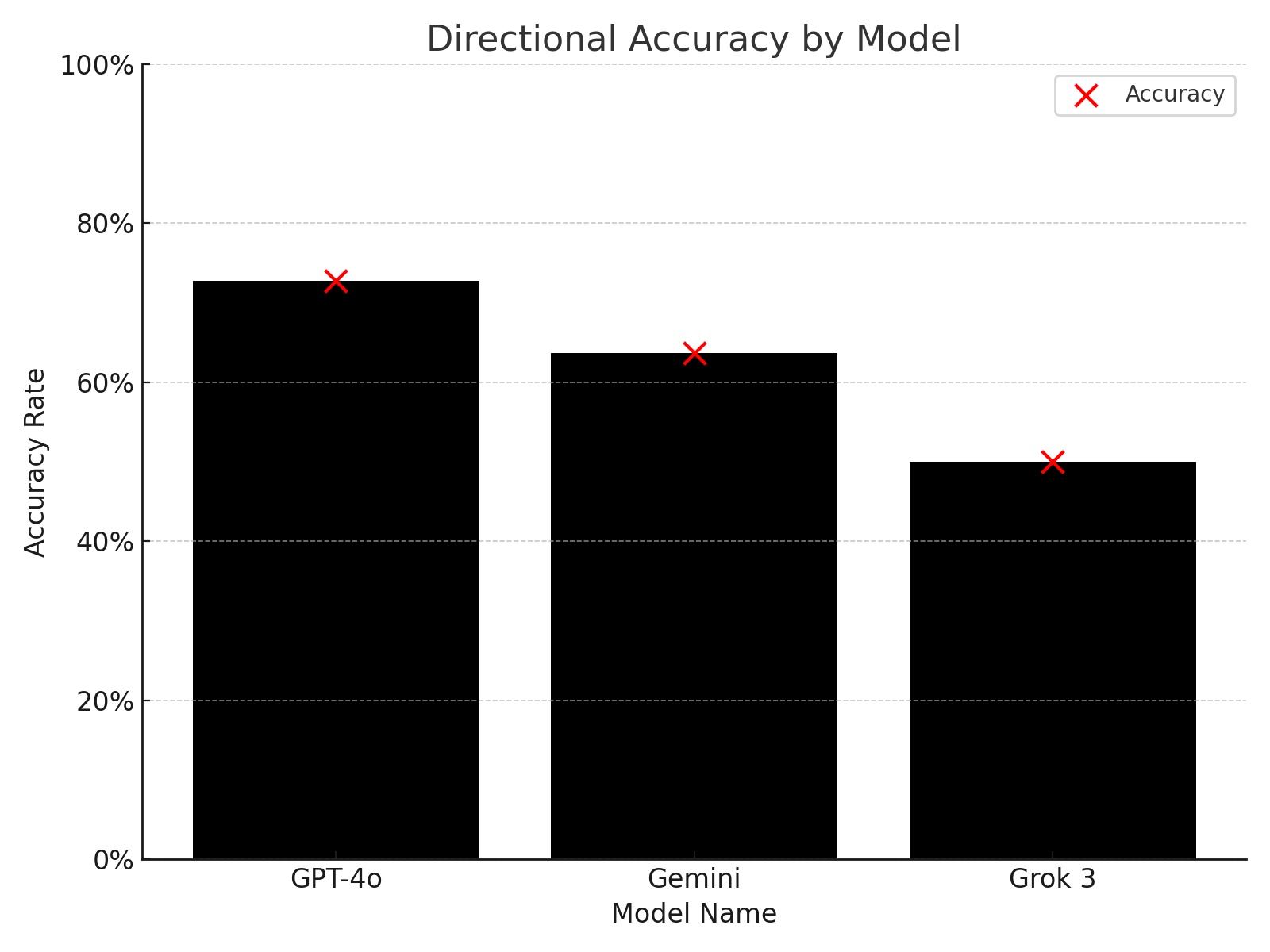

Directional Accuracy

- GPT-4o leads with approximately 70% accuracy.

- Gemini and Grok 3 exhibit weaker directional prediction accuracy (50%-60%).

Qualitative Findings

Reasoning Quality

- GPT-4o: Clear, precise, and consistently aligned with market outcomes.

- Gemini: Generalized and often ambiguous reasoning.

- Grok 3: Primarily technically oriented, weaker in interpreting macroeconomic factors.

Confidence Interpretation

- GPT-4o: Realistically assigned confidence ratings, slight overconfidence in volatile markets.

- Gemini: Erratic confidence levels often disconnected from clear rationale.

- Grok 3: Conservative confidence, cautious approach, underestimating macroeconomic impacts.

Error Pattern Analysis

- Models commonly err during sudden, volatile market shifts.

- GPT-4o errors are smaller and evenly spread.

- Gemini and Grok 3 struggle more significantly with macroeconomic-driven events.

Directional Prediction

- GPT-4o reliably predicts market trends, beneficial for trading strategies.

- Gemini's directional predictions are inconsistent.

- Grok 3 underperforms significantly in predicting market direction influenced by external events.

Model Comparative Summary

| Model | Strengths | Weaknesses |

|---|---|---|

| GPT-4o | High accuracy, clear reasoning, strong directional predictions. | Occasional mild overconfidence. |

| Gemini | Captures general market sentiment moderately well. | Vague reasoning, inconsistent confidence alignment. |

| Grok 3 | Strong technical reasoning and cautious confidence levels. | Poor macroeconomic awareness, lower directional accuracy. |

Recommendations

- Primary Use of GPT-4o: Leverage GPT-4o for clear insights and directional trading decisions.

- Enhance Gemini: Improve reasoning specificity and confidence calibration through targeted retraining.

- Expand Grok 3's Macro Integration: Incorporate macroeconomic indicators to enhance reliability.