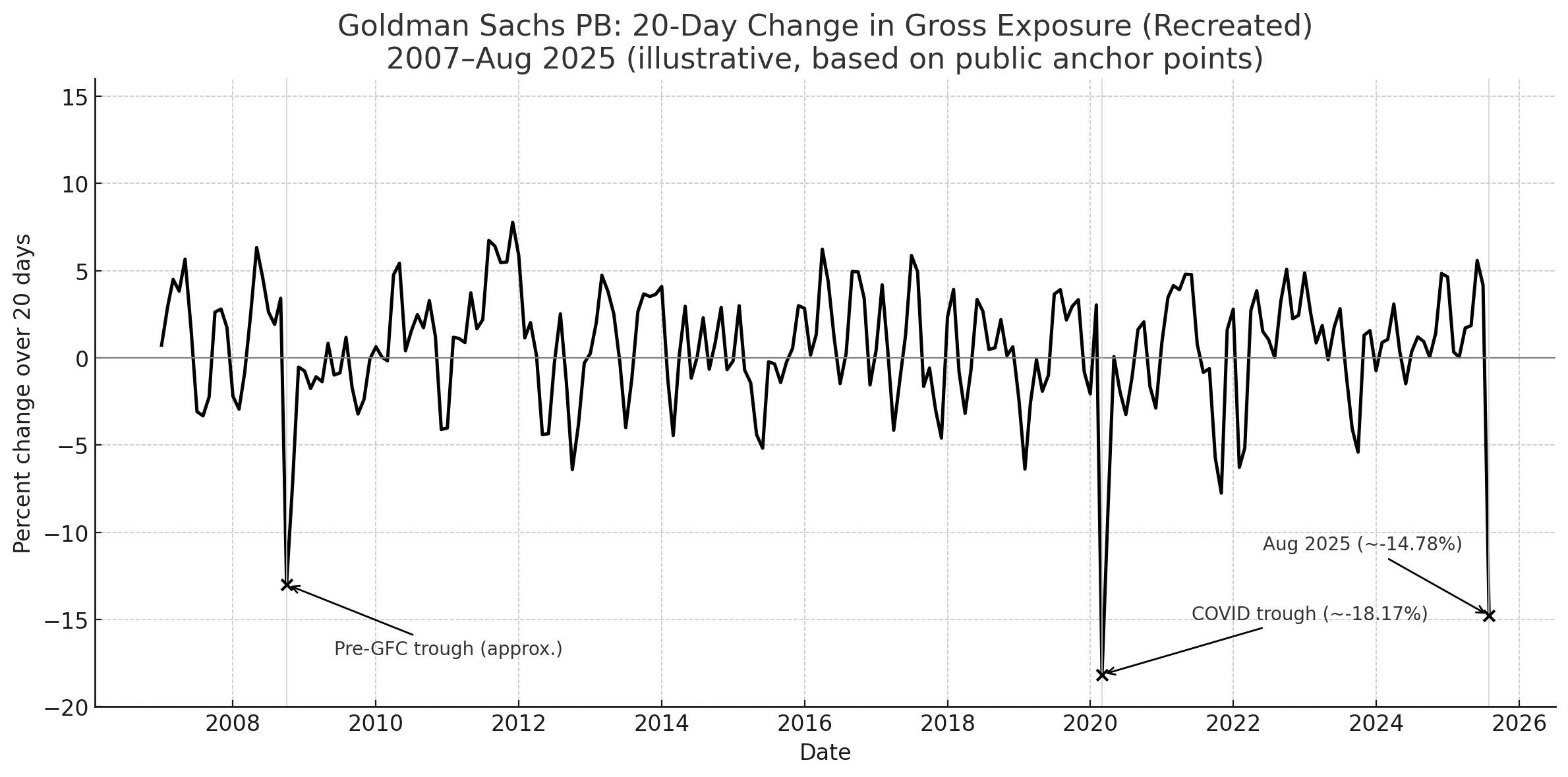

Hedge Funds are Degrossing in What is the Biggest Pullback Since COVID

Signals from Goldman Sachs prime brokerage data are hard to ignore, Mostly because these signals are telling us turbulent times are on the horizon. Gross exposure across its hedge fund client base dropped almost 15% in the past 20 days, making this the largest contraction since the COVID crash in March 2020. Degrossing is where both long and short books are reduced simultaneously, cutting market exposure without changing the directional bias. Funds do this with the intention to step back from a volatile market. The magnitude of this reduction puts it in the same league as the pullbacks that preceded the GFC and the Eurozone debt crisis. Goldman’s data shows gross leverage declining from ~230% in late 2023 to around 210% this quarter, with net leverage dropping to the mid-50% region.

Positioning changes don’t happen in isolation, the data tells a sobering story. Goldman’s Hedge Fund Trend Monitor tracks around $3.1 trillion in equity from ~700 funds, and it still shows major concentration in megacap tech (Microsoft, Amazon, Nvidia, Meta, Alphabet). But hidden under all of that concentrated equity there's a rotation toward energy and financials. Connect the dots; Gold is trading at $3370 an oz, near all time highs, while the VIX closed a week prior near the 20s, indicating expectations of high volatility. High yield credit spreads have widened to 295, near levels that historically signal economic stress. The US 10yr yields are sitting at 4.2 percent with a steepening curve, a shift–you guessed it–typically associated with late cycle concerns. Put these together and you can understand why these funds are pulling back at a pace not seen in five years.

Though degrossing does not mean full on deleveraging, it acts like a precursor, and that difference is important. Deleveraging reduces leverage by lowering the ratio of exposure to equity. Degrossing, on the other hand is the literal reduction of exposure regardless of net bias. Currently the data suggests funds are reducing their exposure to the market, which may rapidly expand into a larger unwind if we see conditions worsening. Historically, large degrossing phases have been followed by aggressive selling when liquidity tightens.

Enjoyed this? Take a look at Hedge Funds Are Exploiting Earnings Beats — And They’re Not Subtle.