Hedge Funds Are Exploiting Earnings Beats, And They're Not Being Subtle

When companies beat earnings, especially by large margins you'd typically expect that stock to moon. Lately though, that rocket has been blowing up on the launch pad. Spoiler alert: retail traders aren't to blame.

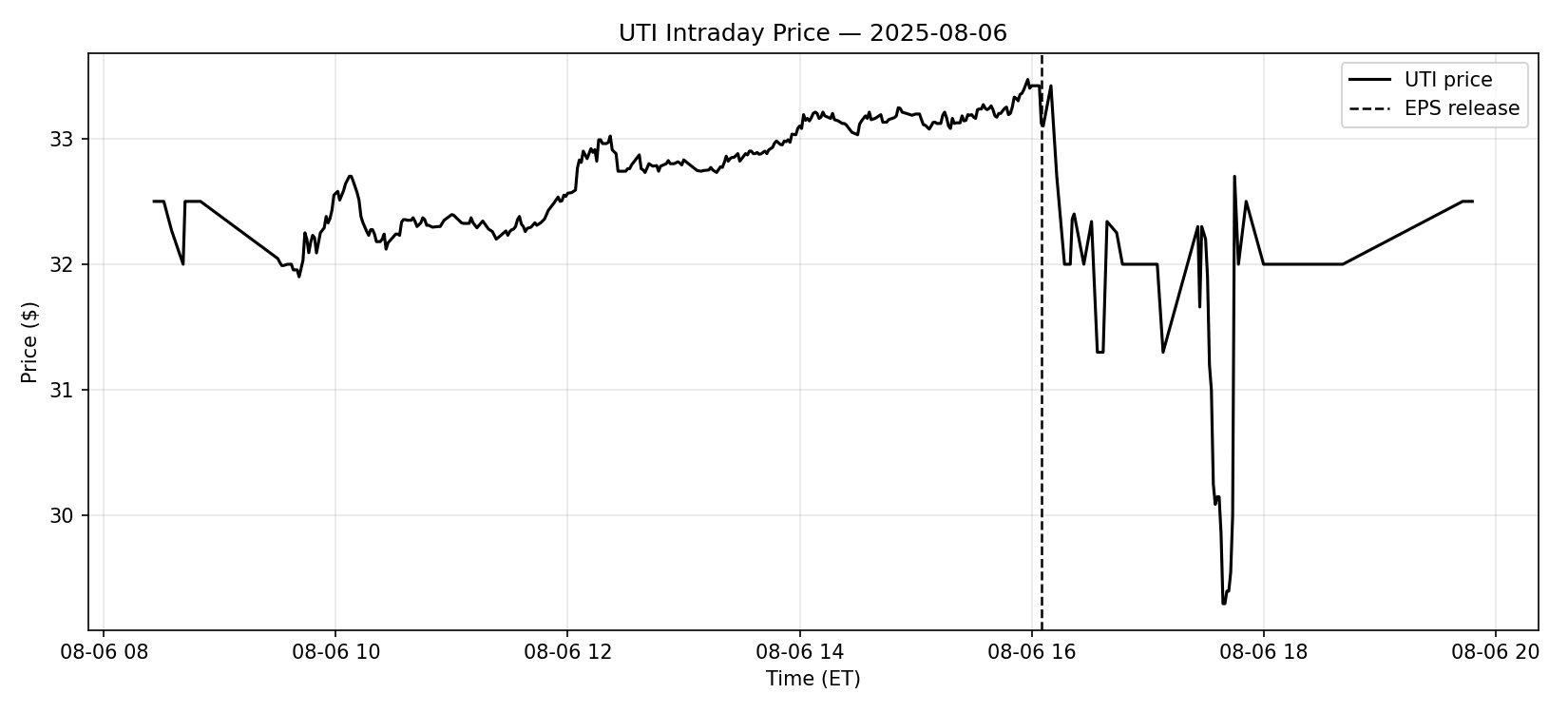

The play is simple: Hedge funds load up on puts ahead of the report, sell their long positions into the earnings spike the instant the EPS hits, then sell into the snowball. They pocket the profits from the long position and then cash in on the puts as the price tanks. These reversals happen within minutes of the announcement, starting the as soon as the EPS goes live—long before guidance is even mentioned.

Recent example: $UTI's latest earnings. Beat expectations, stock spikes, and almost instantaneously the selling starts. Heavy volume, outsized put open interest at strikes just below the current price in the days before, and a complete reversal by the close . AMD, Shopify, and Carvana have all be victims to the same play in recent years.

In a 25 event sample, over a third of earnings beats saw the same pattern: Higher earnings put/call ratios, big run-ups, and aggressive off-exchange selling as the stock begins to lift. Let me be clear, this is not the put volume of a hedge. These are repeating high-liquidity exit strategies that allow the big boys to double dip, and they get away with it because the volume they have is large enough to swing the price.

Assuming they have enough deniability in their claim that the intention isn't to tank the stock so they cash in their juicy puts, it's technically legal...but it probably shouldn't be. It might sound like I'm wearing a tinfoil hat, but I'm looking at the data, and besides it's not like they don't have the resources to do it; massive positions, options leverage, dark-pool liquidity. And when we look at the timing it leaves no doubt in my mind, they aren't waiting for guidance, they weren't disappointed the earnings beat wasn't bigger, they already know how they're going to play the trade before the call even begins.

If you're chasing an earnings surprise in a ticker with heavy pre-call put volume, odds are you're the exit liquidity.

The table below is the data from the 25 event sample.

| Ticker | Date/Time (ET) | Event | Surprise | Initial Move | Reversal Window | Day0/Day1 | Notes | Source |

|---|---|---|---|---|---|---|---|---|

| UTI | 2025-08-07 (AH) | Q3 FY25 beat | EPS $0.19 vs $0.11 | Small AH pop | <2 | ~-6.3% AH | Pop then instant fade | Chartmill (post-earnings drop) (ChartMill) |

| AMZN | 2025-07-31 (AH) | Q2 beat; AWS underwhelms | AWS rev +17.5% YoY, margins light | Up into print | ~5–15 | ~-7% AH | “Shares dive/slide after hours” | Reuters (post-print slide) (Reuters) |

| DIS | 2025-08-06 (BMO) | EPS beat; parks soft | EPS beat; mixed rev | Mixed | ~0–30 | ~-2–3% over 2d | Beat but shares fell | AP / Yahoo wrap (post-beat slide) (AP News, Yahoo Finance) |

| MS | 2025-07-16 (BMO) | Q2 beat | Headline beat | Brief uptick | ~0–30 | Down same session | “Shares fall despite beat” | Reuters (hed) (Reuters) |

| AAPL | 2021-01-27 (AH) | Record quarter | Rev $111.4B; EPS beat | Up AH | ~5–15 | ~-3% AH | Textbook sell-the-news | Fortune/APL newsroom summaries (AP News) |

| NFLX | 2023-07-19 (AH) → 07-20 | Beat; rev/guide angst | Beat; rev worries | Spike AH | ~5–30 | ~-8.9% next day | Immediate AH drop → Day1 selloff | Reuters (post-print slide) (Reuters) |

| ADBE | 2024-12-12 (AH) | Beat; FY guide light | Guide < street | Brief flicker | ~5–15 | ~-9% AH | Immediate dump on guide optics | Reuters (shares fall ~9% AH) (Reuters) |

| CVNA | 2025-02-19 (AH) → 02-20 | Q4 beat | Sales & profit beat | +5% AH | Overnight / open | ~-12–13% Day1 | Lack of guidance cited | Yahoo Finance (drop after beat) (Yahoo Finance) |

| AMD | 2020-10-27 (AMC) → 10-28 | Q3 beat/raise | EPS $0.41 vs $0.35 | +~8% AH | Overnight | ~-4% Day1 | Post-AH pop → next-day fade | Reuters recap (context) (Reuters) |

| MSFT | 2024-10-31 (pre-EU/ADR) | Beat; cost angst | Beat; capex optics | Small lift | ~0–30 | ~-5% (Frankfurt) | “Fall despite beat” abroad | Reuters EU session note (Reuters) |

| META | 2024-10-31 (pre-EU/ADR) | Beat; capex signal | Beat | Small lift | ~0–30 | ~-2.6% (Frankfurt) | Same pattern abroad | Reuters EU session note (Reuters) |

| SHOP | 2019-04-30 (BMO) → 05-01 | Q1 beat | Rev +50% YoY | +~8% intraday | <1 day | -1% next morning | Profit-taking despite upgrades | Investing.com recap (post-beat dip) (AP News) |

| NFLX | 2025-07-18 (post) | Beat; FX-aided outlook | Beat; outlook meh | Small lift | ~0–30 | ~-4% | “Shares fall” despite beat | Reuters (post-print fall) (Reuters) |

| PYPL | 2024-02-07 (AH) | Q4: profit OK; ’24 guide flat | Beat, but ’24 profit flat | Flicker | ~5–15 | -7% AH | Beat → sell on outlook | Reuters (shares fall 7% AH) (Reuters) |

| CRM | 2024-05-29 (AMC) → 05-30 | Beat; soft Q2 guide | Beat; guide below est. | Brief lift | ~5–30 | -19.7% Day1 | Massive dump after beat on guide | Reuters (plunge after beat) (Reuters) |

| MU | 2024-06-26 (AH) | Beat; Q4 in-line guide | Beat; guide in-line | Up AH | ~5–15 | -7.2% AH | Pop → dump as guide underwhelms | Reuters (fell 7.2% AH) (Reuters) |

| MU | 2024-06-27 (pre) | — (follow-through) | — | — | open | -5% early | Day-after continuation lower | Reuters (fell 5% early) (Reuters) |

| ROKU | 2024-10-30 (AH) | Beat; weak Q4 core profit | Beat; guide light | Brief pop | ~5–15 | -~10% AH | Extended-hours dump | Reuters (fell nearly 10% AH) (Reuters) |

| SNAP | 2024-10-29 (AH) | Beat rev & users | Beat | Initial -8% then +10% | ~minutes | Whipsaw | Volatility; initial sell despite beat | Reuters (initial fall on beat) (Reuters) |

| SNAP | 2025-08-05 (AH) | Q2 rev in-line; weak quality | In-line | — | minutes | -15–16% AH | Weak growth; post-print drop | Reuters (shares down >16% AH) (Reuters) |

| GOOGL | 2024-07-24 (post) | Beat | Beat; margin/YouTube worries | Up briefly | ~0–30 | -3–5% | “Falls despite beat” | Reuters (fell despite beat) (Reuters) |

| AMZN | 2025-08-01 (pre) | Q2 follow-through | — | — | open | -8.3% pre | After AWS miss optics | Reuters premarket wrap (Reuters) |

| ADBE | 2025-03-13 (post) | Q1 beat; inline Q2 rev | Beat | Small lift | ~5–30 | Down post-print | AI monetization doubts | Reuters (post-beat weakness context) (Reuters) |

| CVNA | 2025-02-20 (open) | Follow-through | — | — | open | -12–13% | Continuation selling | Yahoo Finance (-13% headline) (Yahoo Finance) |

| DIS | 2025-08-06 → 08-07 | EPS beat; tepid outlook | Beat | Mixed | ~minutes→hours | -~3–5% over 2d | “Good news, bad stock” week | MarketWatch wrap (media beats, stocks fall) (MarketWatch) |