The Gold Risk Compass

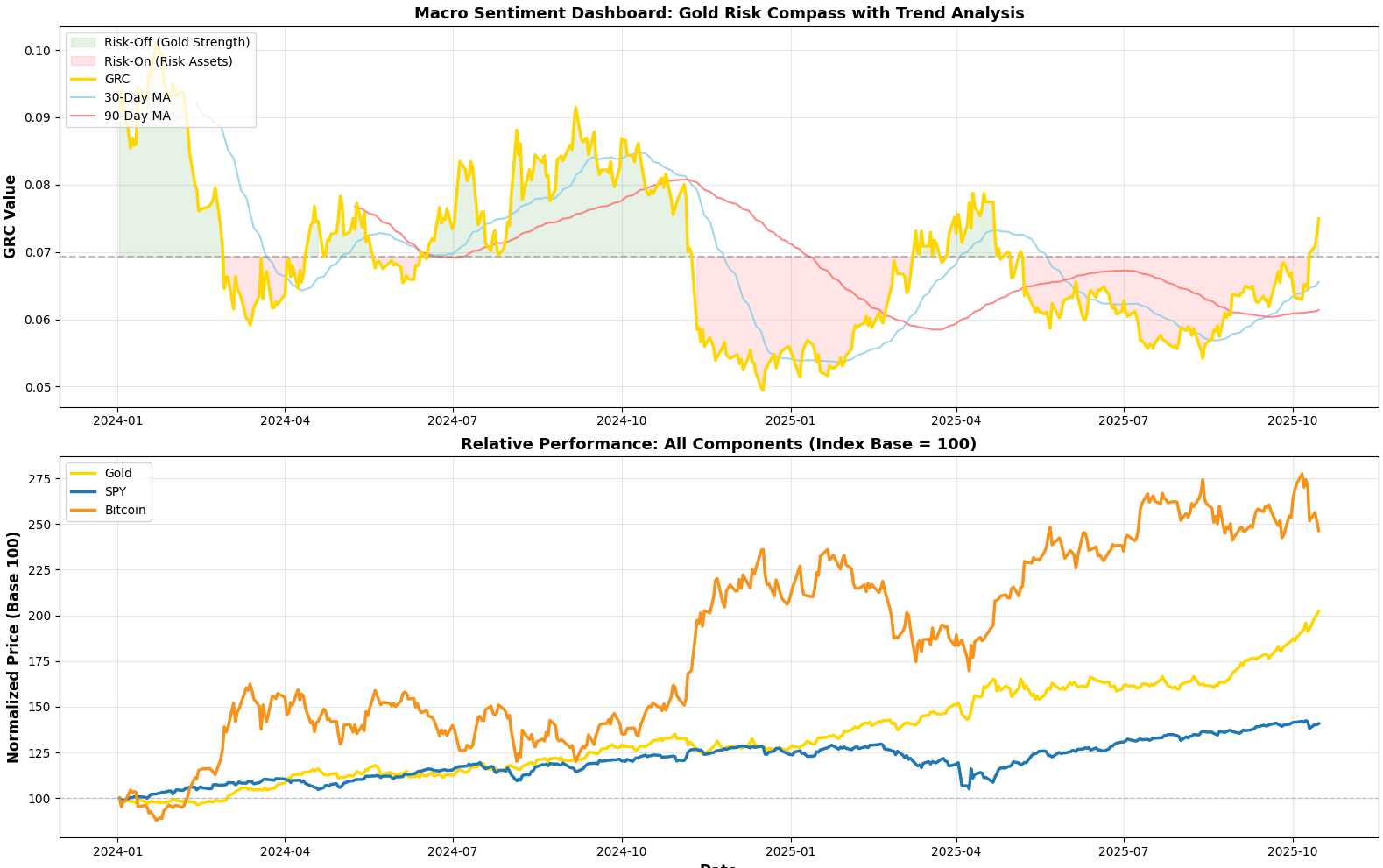

Gross exposure, credit spreads, and volatility ($VIX) usually dominate headlines when the market starts to shake. But shifts in capital rotation often show up first. The Gold Risk Compass (GRC) is my attempt to track that rotation. It’s a simple cross-asset ratio that compares gold’s strength to a blended basket of risk assets (SPY and BTC).

There are already plenty of similar indicators out there, and someone has probably built a cleaner version, but this one’s mine. It’s straightforward, easy to track, and it gives me a clear read on when money starts quietly moving toward safety.

The Gold Risk Compass (GRC) measures capital rotation between “safety” and “speculation.”

Its a simple formula: GRC = Gold / ((SPY + BTC) / 2)

When gold strengthens relative to equities and crypto, GRC rises signaling risk aversion and the potential for volatility. When it falls, speculative capital takes charge, disclosing risk-on behavior.

Over the past several months, GRC has been climbing off its lows, breaking above its 30 day moving average and pressing into the upper half of its 90 day range. The pattern mirrors previous risk off phases that preceded liquidity contractions, most notably mid-2018, early-2020, and late-2021.

GRC represents a behavioral ratio tracking how investors allocate their money across asset classes. This is what we’re seeing right now:

- Gold trading at all time high shows a defensive bid that hasn’t faded despite rate stability (uncommon).

- SPY continues to hold highs, while breadth is narrowing, energy and utilities are start outperforming growth.

- Bitcoin remains volatile but rolls sideways, and continues lower highs since April.

Put together, the numerator (gold) is rising while the denominator (risk assets) is melting upwards. That's not sustainable in a calm market so volatility expands.

Through back testing every major regime shift in the past decade saw GRC rise first:

- Late 2018: GRC spiked as global PMIs rolled over and the Fed blinked.

- Q1 2020: It exploded upward roughly two weeks before the VIX breached 40.

- Late 2021: It climbed through the fourth quarter while megacaps were still hitting all-time highs, six weeks later, the S&P 500 topped.

GRC’s leading quality comes from what it measures: reallocation thats a precursor to volatility.

Macro Confirmation

The rotation captured by GRC lines up with other structural stressors:

- Goldman Sachs prime brokerage data shows hedge funds degrossing, cutting exposure without flipping net short—at the fastest pace since 2020.

- High-yield spreads are widening (≈295 bps), while 10-year yields hover around 4.2% with a steepening curve.

- VIX holding near the low-20s suggests volatility is underpriced relative to liquidity risk.

These don’t act in isolation, for all intents and purposes it’s the same capital migration that GRC visualizes, just viewed from different angles.

If you ignore the rest, read this!

GRC is an unfiltered sentiment gauge.

It ignores the noise of options positioning, ignores realized volatility, and looks at allocation behavior. When it rises, portfolios are getting heavier in metal and lighter in momentum. When it falls, investors are feeling better with risk.

At the moment, GRC is sending the same quiet warning it gave before the 2020 crash: capital is pulling back from the frontier of speculation.

My Thesis

If the GRC continues to rise while SPY and BTC stall, the signal implies a tightening liquidity era and potential “equity mean reversion”. The relationship is about identifying when the market’s risk tolerance stops expanding.

I’ll add more and edit this later today. The goal is to Normalize the values and create a fear/greed index that’s based on the numbers and not on polling